[ad_1]

The Bank of Canada is finally coming around to the view that the rising cost of goods and services is perhaps not so transitory after all.

The following is the key line from the Bank’s most recent Monetary Policy Report:

“The recent increase in CPI inflation was anticipated in July, but the main forces pushing up prices—higher energy prices and pandemic-related supply bottlenecks—now appear to be stronger and more persistent than expected.”

It has been clear for months now that this was not a base effects issue (i.e., inflation is only high now because it was so low last year), which was one thing we heard from pundits earlier this year. The September Consumer Price Index (CPI) inflation report provided further confirmation with one of the strongest three-month increases in core CPI (seasonally adjusted) since the early 2000s. Inflation is happening in real-time.

We’re also seeing the breadth of inflationary pressures expanding beyond industries initially affected by supply chain disruptions. The number of CPI sub-components seeing increases of more than 3% is the highest it’s been since the early 1990s.

And things aren’t cooling down, either. The price of raw materials purchased by manufacturers increased 2.5% month-over-month in September and was up a whopping 31.9% year-over-year, while the Industrial Product Price Index, which measures the price of finished manufactured goods, registered a 1% monthly increase and was still up 0.6% even once volatile energy prices were stripped out. It’s now up 15% annually overall, the highest reading since the series began in the early 1980s. Those prices will flow through to consumers in due time.

Signs point to high inflation persisting long-term

There’s no reason to think inflationary pressures are set to abate anytime soon.

For starters, price plans hit a new record in the latest CFIB (Canadian Federation of Independent Business) Small Business Barometer. This series has an excellent track record of predicting core inflation trends six months out. Nearly half of respondents are now expecting to raise prices by more than 5%, which is a record for the series by a wide margin.

Meanwhile, the monetary base continues to expand rapidly with M2, a broad measure of the money supply, now growing 11% year-over-year versus a 6.3% average since 1990. The two-year change is over 30%, the highest it’s been in nearly 40 years.

So, all of this points to more inflationary pressures ahead.

What’s generally needed to sustain inflation over the longer term is a broad increase in wages. While that’s not in the official data yet, it’s likely only a matter of time.

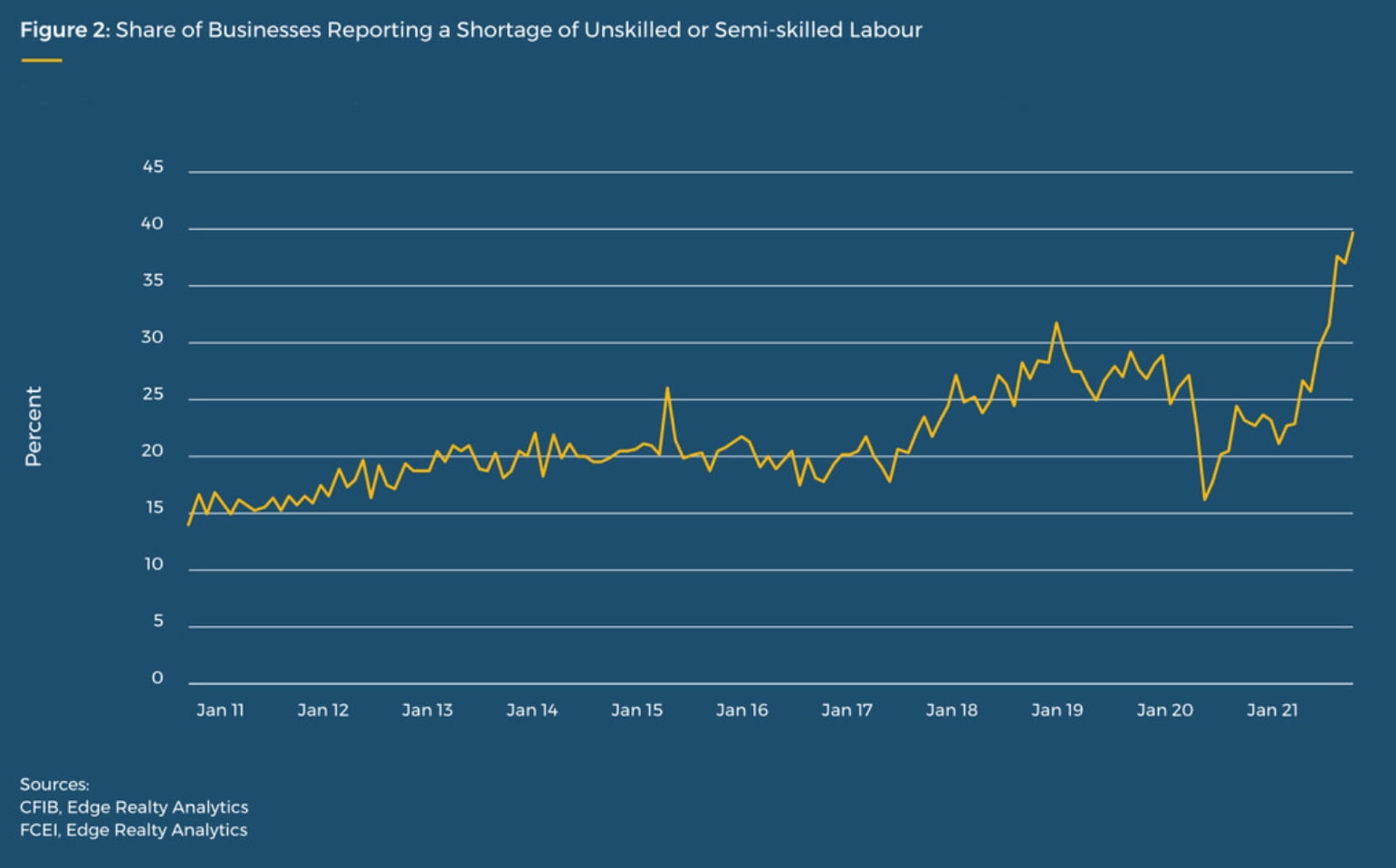

Another factor to look at is the share of businesses reporting labour shortages, which set a new high again in October. And this is at a time when hiring intentions among businesses are the strongest on record:

This suggests that workers finally have bargaining power again, and it’s happening at a time when they are starting to feel the pinch from rising prices. It all points to strong wage growth ahead.

The impact on interest rates

So, what does all this mean for interest rates?

Clearly, the Bank of Canada is taking on a more hawkish tone and is rightfully concerned about rising prices. But, how much room do they actually have to move rates before causing real pain in the broader economy?

Markets are now pricing in five quarter-point rate hikes by this time next year, but let’s think about what that would mean.

If we look at the household debt service ratio and make some conservative assumptions regarding aggregate income growth (1% per quarter) and debt growth (1.5% per quarter) and then model out an 80-basis-points rise in the effective interest rate—which is about the flow-through in one year from a 125-bps hike—we would hit new all-time highs by early 2023.

Now, if income growth really takes off, it will certainly help. And the record pile of excess household savings, currently estimated at a quarter of a trillion dollars, would also act as somewhat of a buffer. But this would still slam the brakes on consumption and housing investment, which, combined, have accounted for nearly 85% of real GDP growth over the past year.

And that’s just the impact on households. Broaden things out to include non-financial businesses and we end up with a combined debt-service ratio of 23% and total debt-to-GDP equivalent to 240% of GDP…66 points above the G20 average.

This level of indebtedness is exactly the sort of limiter that will make it very difficult for the Bank to normalize interest rates.

Instead, they will likely be more inclined to let prices run hotter than they have in previous cycles and allow inflation to eat away at the burden of debt over time. In fact, a Bank of Canada staff analytical note released this summer, appropriately titled Exploring the Potential Benefits of Inflation Overshooting, is about as clear a signal as they could give on this front.

The days of ultra-cheap mortgages may be behind us, but at this point, the fear of rising rates is likely overblown.

This piece was originally published in Mortgage Professionals Canada’s Perspectives magazine (Issue #4, 2021).

Article feature image by David Kawai/Bloomberg via Getty Images

[ad_2]

Source link